FUND OVERVIEW

Sound Real Estate Investments with High Yields

- Mainly residential first position and second position mortgages.

- Portfolio duration up to 1 year with the goal of recycling the mortgage.

- Maximum 90% Loan-to-Value ratio that offer marketable collateral in real estate.

Fund

Information

Minimum

Investment

Target Yield

(A Class)**

9-11% per annum

NAV Purchase

value

Redemption Terms

& Lock Up Period

Manager &

Legal Counsel

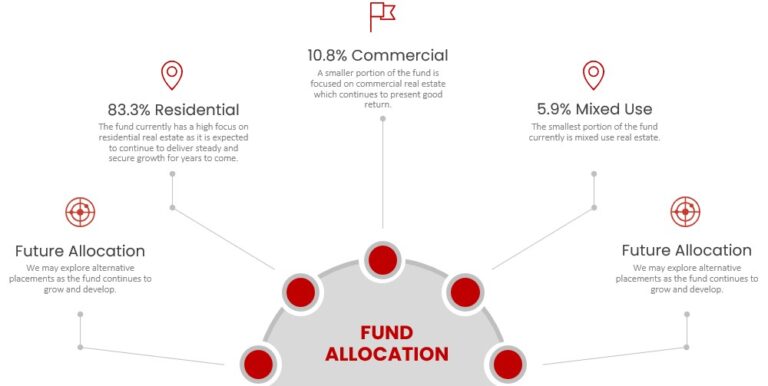

Fund Allocation

Our fund allocation strategy is primarily focused on residential mortgages, comprising the majority of our portfolio. We recognize the stability and growth potential offered by the residential real estate market, and we leverage this to generate consistent returns for our investors. Additionally, we allocate a portion of our fund towards commercial real estate investments, providing diversification and potential for enhanced yields. Furthermore, we selectively invest in mixed-use properties, although to a lesser extent, to capitalize on unique opportunities that offer a blend of residential and commercial income streams. With a commitment to maximizing returns while managing risk, our fund employs diverse allocation strategies tailored to the evolving market landscape. This approach ensures flexibility and adaptability, allowing us to capitalize on emerging trends and opportunities in the real estate sector.

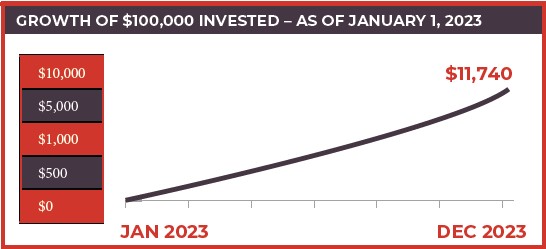

Growth Overview

Our growth overview emphasizes the potential for substantial returns on investment, highlighting the opportunity to achieve significant growth within our fund. With an initial investment of $100,000, investors have the potential to realize annual gains ranging from $9,000 to $12,000. This growth projection underscores our commitment to delivering attractive returns and capital appreciation for our clients. Leveraging our expertise in residential and commercial real estate investing, coupled with diverse allocation strategies, we aim to capitalize on market opportunities to maximize returns and enhance wealth accumulation. Our proactive approach to portfolio management and rigorous risk assessment ensures that investors have the opportunity to achieve their financial goals and secure long-term prosperity through our fund.

Get the Fund Sheet

Free Consultation & In Depth Review

To receive our fund sheet, please provide us with your contact information, including your name, email address, and any other relevant details. Once we receive your information, we’ll promptly send you our fund sheet so you can review our investment strategy, performance, and other key details. Thank you for your interest in our fund!

Sound Real Estate Investments with High Yields

- Mainly residential first position and second position mortgages.

- Portfolio duration up to 1 year with the goal of recycling the mortgage.

- Maximum 90% Loan-to-Value ratio that offer marketable collateral in real estate.

Get the Fund Sheet

Free Consultation & In-Depth Review

To receive our fund sheet, please provide us with your contact information, including your name, email address, and any other relevant details. Once we receive your information, we’ll promptly send you our fund sheet so you can review our investment strategy, performance, and other key details. Thank you for your interest in our fund!

Reader Advisory

Readers are advised that the material herein should be used solely for informational purposes. Good Canadian Capital/Holdings does not purport to tell or suggest which investment securities members or readers should buy or sell for themselves. Readers should always conduct their own research and due diligence and obtain professional advice before making any investment decision. Good Canadian Capital/Holdings will not be liable for any loss or damage caused by a reader’s reliance on information obtained in any of our presentations, special reports, email correspondence, or on our website. Our readers are solely responsible for their own investment decisions.

The information contained herein does not constitute a representation by the publisher or a solicitation for the purchase or sale of securities. Our opinions and analyses are based on sources believed to be reliable and are written in good faith, but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. All information contained in our presentations or on our website should be independently verified with the companies mentioned. The editor and publisher are not responsible for errors or omissions. Past performance does not guarantee future results. Unit value and investment returns may fluctuate and there is no assurance that the fund can maintain a specific net asset value. The fund is available to investors eligible to invest under a prospectus exemption, such as accredited investors. Prospective investors should rely solely on the Fund’s offering documentation, which outlines the risk factors in making a decision to invest.

Any opinions expressed are subject to change without notice. The Good Canadian Capital/Holdings employees, writers, and other related parties may hold positions in the securities that are dis-cussed in our presentations or on our website.